What is the best landlord insurance for an LNPG member?

It might seem like a simple question, but when you ask what the best landlord insurance is, there’s really a lot more to think about before you can find the answer. Here at Protect My Let, we don’t like to complicate things or make fluffy promises; instead we’ve broken down the main things you need to think about in order to find out how you find the best landlord insurance.

In order to get the best landlord insurance, you first need to answer the question: What is your goal?

We all love a deal and in an ideal world you’d get the most comprehensive policy for the same cost as a basic one – or being honest, you’d probably like to not have to pay for landlord insurance! Unfortunately, the reality is that neither is an option, so in order to find the best landlord insurance for you, you need to ask yourself what is your realistic landlord insurance goal? What is the most important thing to you? Whatever the answer to this is, as an LNPG member you can be assured that we at Protect My Let will be there to help you achieve it, just like we have with so many other LNPG members.

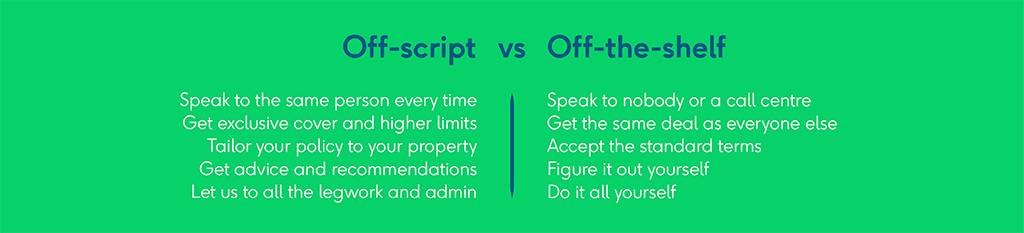

How much support do you want or expect?

We appreciate that some landlords want more service than others so you need to ask yourself – do you want a good service and someone you can rely on? If this is the case then you’re in luck as that’s our entire ethos. We’re here to help and pride ourselves on the level of service we provide to LNPG members.

Do you have a bad claims history?

If you have a bad claims history on your landlord insurance, then you may find your goal is to get some decent cover in place which doesn’t penalise you too harshly for your claims. Or perhaps your property will always be considered high-risk and you find it hard to find an insurer who will offer the cover you’re after. If this is the case then we’d suggest that for you, working with an experienced broker would provide you with the best landlord insurance for your circumstances. As LNPG’s preferred supplier, we have experience in placing difficult risks for members. We also have access to a panel of insurers, which means we will have more options for you than a one-stop-shop on a comparison website.

What type of cover do you need?

Main Cover

There are three main types of cover that your landlord insurance will provide: Buildings, Contents or a combination of both. You’ll be able to get any of these easily and all will be available on a basic or more comprehensive policy.

Buildings

This will cover the main structure of the building (including outbuildings if any) plus any fixtures and fittings inside the property i.e. kitchens and bathrooms, including integrated appliances and permanently fitted flooring.

Contents

This is designed to cover any furniture owned by you and any other loose items, including carpets, however, fixtures and fittings cover can also be included if the property is a leasehold e.g. a flat.

If you own the freehold of a property, it is most likely that you would need Buildings or a Buildings and Contents combination.

Legal Expenses cover

Another type of cover that landlord insurance can provide is Legal Expenses. This protects you against a variety of situations that can happen as a landlord that would normally leave you having to foot the bill for legal fees, including having to serve evictions or pursuing rent arrears.

Liability cover

As a landlord, you are also responsible for looking after your tenants in certain situations. For example, if your property becomes uninhabitable, it’s up to you to temporarily rehome them. This cover is provided in the form of Loss of Rent/Alternative Accommodation cover.

There are other things to consider too such as who is responsible if a tenant or their family is injured in the property as a result of your fixtures and fittings, or what happens if their property is damaged. This is where Property Owners Liability comes in.

What tenants are you letting to?

Each type of tenant comes with their own risks, but some can be harder to get insurance for, meaning if cost is your main driver and you have a high-risk tenant, you might not be able to achieve a really low-cost policy. Equally, some insurers do not offer cover for certain tenant types so you might find it hard to find insurance full stop. Depending on your tenants, you will have a different goal in respect of finding the best landlord insurance for you, so it’s important to bear this in mind when looking for your new policy.

I know my goal; what are the next steps to finding the best landlord insurance for me?

Get in touch with a broker

If you decide to join the LNPG then you’ll have access to our exclusive member benefits which is a great place to start! Once you have joined, we’ll be in touch to see how we can help and if you’ve already sorted your insurance we’ll put a reminder in to contact you before your renewal to see if our member benefits can help. Remember, working with a broker, you’re more likely to reach your goal and you get the added bonus of not having to do it all yourself!

Be clear about your goals

Being open about your goals and providing all the required information from the start is going to make the process a lot faster. It will also mean we have a higher chance of achieving your goal.

Be realistic about your goals

If you have a high-risk property or a bad claims history, it’s unlikely that you’ll ever be able to achieve the very cheap prices you may have seen advertised online. If you’ve been clear from the start, I promise that as your broker we’ll always be realistic in what is achievable from our markets and experience.

Review your insurance options and place cover smoothly

We’ll provide you with options that suit your needs, and often we’ll also give some other options which might provide cover for things that you hadn’t thought of. Once we’ve discussed your options, we’ll place the one you choose. Your property will be covered and you’ll be safe in the knowledge that it’s the right cover and that together, we hit your goals.